The Ultimate Guide To Transaction Advisory Services

The Transaction Advisory Services Ideas

Table of ContentsTransaction Advisory Services for DummiesOur Transaction Advisory Services StatementsThe Main Principles Of Transaction Advisory Services Some Ideas on Transaction Advisory Services You Should KnowA Biased View of Transaction Advisory Services

This action makes sure business looks its ideal to possible purchasers. Getting business's worth right is important for a successful sale. Advisors use various approaches, like reduced cash money circulation (DCF) evaluation, contrasting with comparable companies, and current transactions, to find out the reasonable market worth. This aids establish a reasonable rate and discuss efficiently with future purchasers.Transaction advisors step in to aid by getting all the required info arranged, answering questions from buyers, and arranging brows through to the company's location. This builds trust with purchasers and keeps the sale relocating along. Obtaining the ideal terms is key. Transaction advisors utilize their competence to assist service owners deal with tough negotiations, meet customer expectations, and structure bargains that match the proprietor's objectives.

Fulfilling legal rules is crucial in any service sale. Purchase consultatory services deal with lawful specialists to develop and review agreements, contracts, and various other legal documents. This reduces threats and ensures the sale adheres to the legislation. The function of purchase advisors expands beyond the sale. They aid service proprietors in preparing for their following actions, whether it's retired life, starting a brand-new endeavor, or handling their newly found riches.

Transaction advisors bring a wide range of experience and knowledge, making certain that every facet of the sale is dealt with professionally. With calculated prep work, evaluation, and settlement, TAS assists local business owner attain the greatest feasible price. By ensuring legal and regulatory compliance and managing due persistance alongside other bargain employee, transaction advisors minimize potential risks and liabilities.

Transaction Advisory Services - The Facts

By comparison, Large 4 TS groups: Deal with (e.g., when a prospective customer is conducting due persistance, or when a bargain is shutting and the buyer needs to integrate the business and re-value the seller's Balance Sheet). Are with fees that are not linked to the offer shutting efficiently. Gain fees per interaction someplace in the, which is much less than what investment financial institutions gain also on "small bargains" (but the collection likelihood is additionally a lot higher).

, however they'll concentrate more on audit and appraisal and less on topics like LBO modeling., and "accounting professional only" topics like test continue reading this balances and how to stroll via occasions using debits and credit reports rather than financial statement modifications.

Some Of Transaction Advisory Services

Specialists in the TS/ FDD groups might likewise interview monitoring regarding whatever above, and they'll write a thorough report with their findings at the end of the procedure.

The pecking order in Transaction Services varies a bit from the ones in financial investment financial and private equity professions, and the general form looks like this: The entry-level function, where you do a great deal of information and monetary evaluation (2 years for a promo from right here). The following level up; comparable work, but you obtain the more interesting little bits (3 years for a promo).

In particular, it's tough to get promoted past the Supervisor degree due to the fact that few individuals leave the job at that phase, and you need to start revealing evidence of your capability to create income to advancement. Allow's begin with the hours and lifestyle considering that those are much easier to define:. There are occasional late nights and weekend job, but nothing like the agitated nature of investment banking.

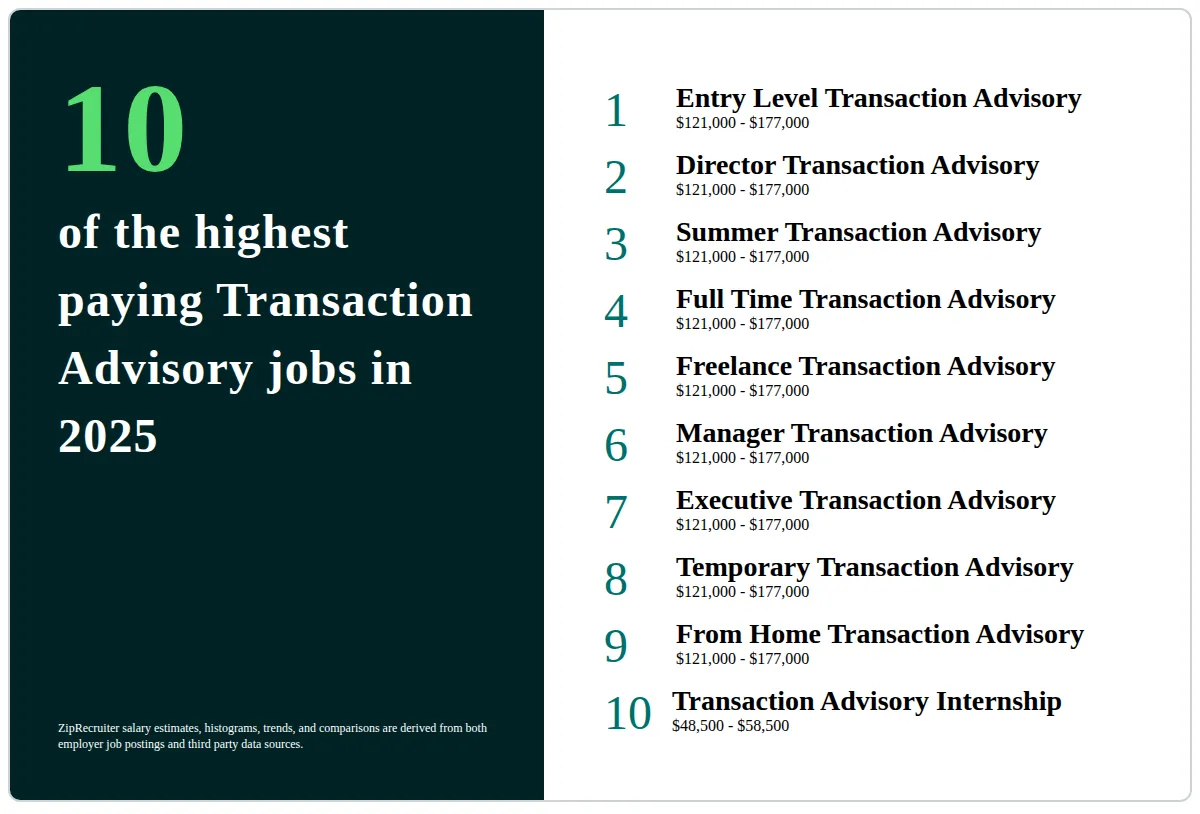

There are cost-of-living changes, so anticipate lower settlement if you're in a less costly area outside major financial (Transaction Advisory Services). For all placements other than Partner, the base pay comprises the mass of the overall settlement; the year-end bonus may be a max of 30% of your base income. Frequently, the best means to enhance your earnings is to change to a different company and work out for a greater wage and reward

Transaction Advisory Services Things To Know Before You Get This

At this stage, you ought to just stay and make a run for a Partner-level duty. If you want to leave, possibly move to a customer and execute their valuations and due diligence in-house.

The main issue is that due to the fact that: You usually need to join another Huge 4 team, such as audit, and work there for a few years and then move right into TS, job there for a couple of years and after that move into IB. And there's still no warranty of winning this IB duty due to the fact that it depends on Recommended Reading your region, customers, and the working with market at the time.

Longer-term, there is additionally some danger of and since assessing a business's historic monetary information is not exactly rocket science. Yes, people will certainly constantly need to be involved, but with even more sophisticated innovation, lower headcounts can potentially support client engagements. That claimed, the Deal Solutions team beats audit in terms of pay, job, and exit chances.

If you liked this post, you may be thinking about reading.

Everything about Transaction Advisory Services

Establish innovative economic frameworks that aid in identifying the actual market value of a firm. Offer advisory work in connection to service appraisal to assist in bargaining and prices structures. Clarify one of the most ideal kind of the bargain and the type of consideration to employ (cash, supply, gain out, and others).

Carry out assimilation planning to determine the procedure, system, and organizational adjustments that may be needed after the bargain. Establish standards for integrating departments, modern technologies, and company procedures.

Analyze the possible client base, industry verticals, and sales cycle. The functional due diligence offers essential understandings into the performance of the Your Domain Name firm to be gotten worrying risk analysis and worth production.